Research

Research

Breakthrough Research & Innovation

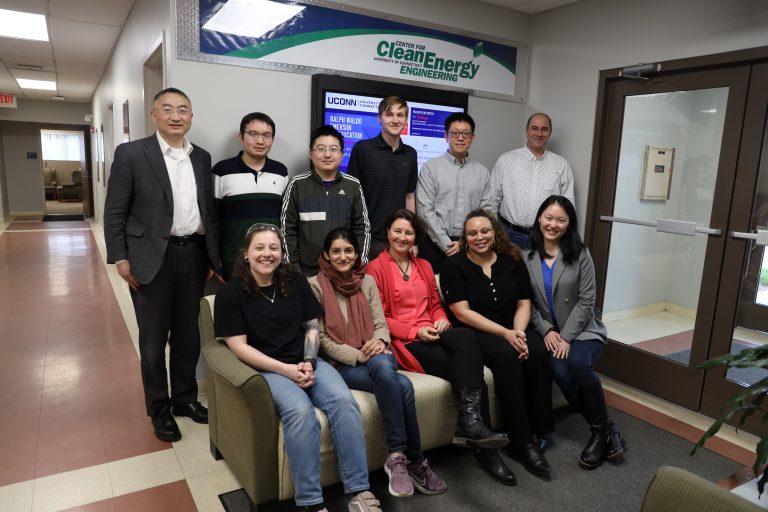

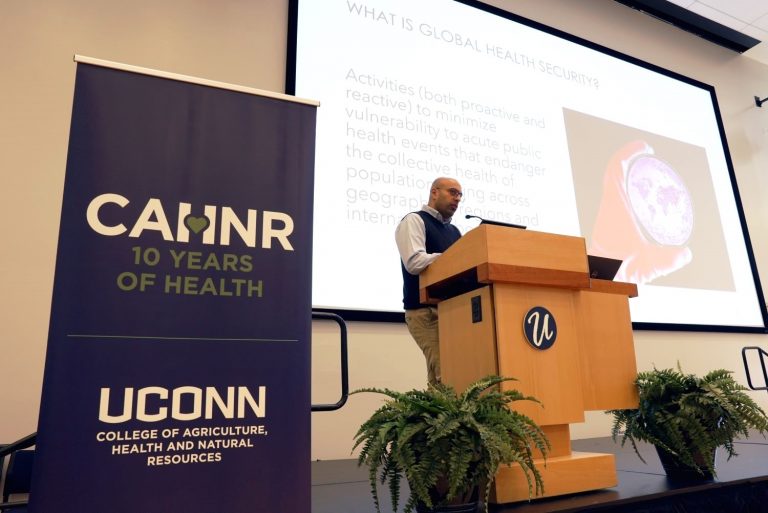

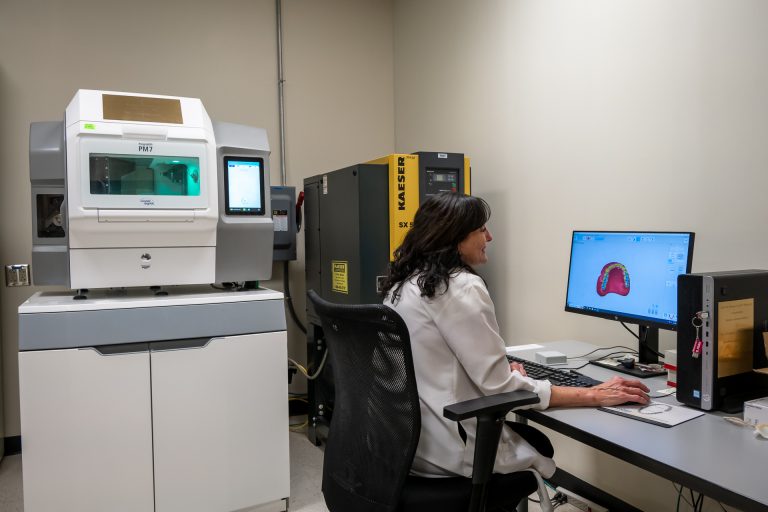

At UConn, our faculty, staff, and students are not just learning about the world around them through research. They are dedicated to making groundbreaking advancements and driving innovation.

With access to state-of-the-art facilities and opportunities to collaborate across disciplines — and around the world — our researchers are tackling big challenges and developing innovative solutions.

14 Schools & Colleges

80+ Research Centers & Institutes

100+ State-of-the-Art Research Facilities

Making an Impact

UConn research makes a difference. With more than 2,000 active researchers who are internationally recognized for excellence in their fields, UConn is educating the next generation of innovators, contributing to conversations about policy and practice, sparking economic impact through innovative discoveries and industry partnerships, and so much more.

$302.3 Millionin AnnualResearch Awards

$620 MillionAnnual Impact onConnecticut's Economy

Partnerships & Reach

At UConn, we believe collaboration accelerates scientific breakthroughs and discovery. Bringing a top research institution like the University of Connecticut together with industry leaders, small- to medium-sized businesses, foundations, and other academic institutions allows us to tackle bigger challenges and find more innovative solutions.

UConn partners with 150 institutions worldwide. We are one of only two U.S. members of the Universitas 21 network, the leading global network of research universities for the 21st century.

Office of the Vice President for Research

The Office of the Vice President for Research manages research activities at the University of Connecticut. From individual projects to large-scale interdisciplinary collaborations, partnerships with industry, and high-potential startups, the Office of the Vice President for Research provides support and oversight at every step.

Quick Links

For Entrepreneurs, Startups & Industry Partners

Technology Commercialization Services

Technology Incubation Programs for Startups